Central Bank Digital Currency Platform

Digital Asset Management

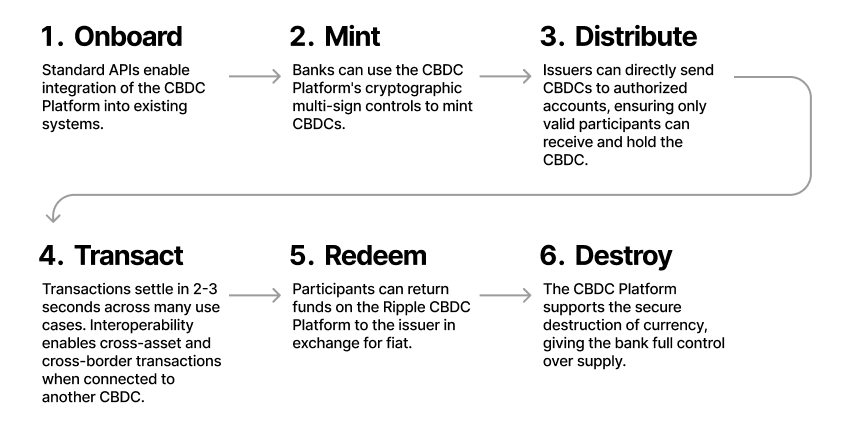

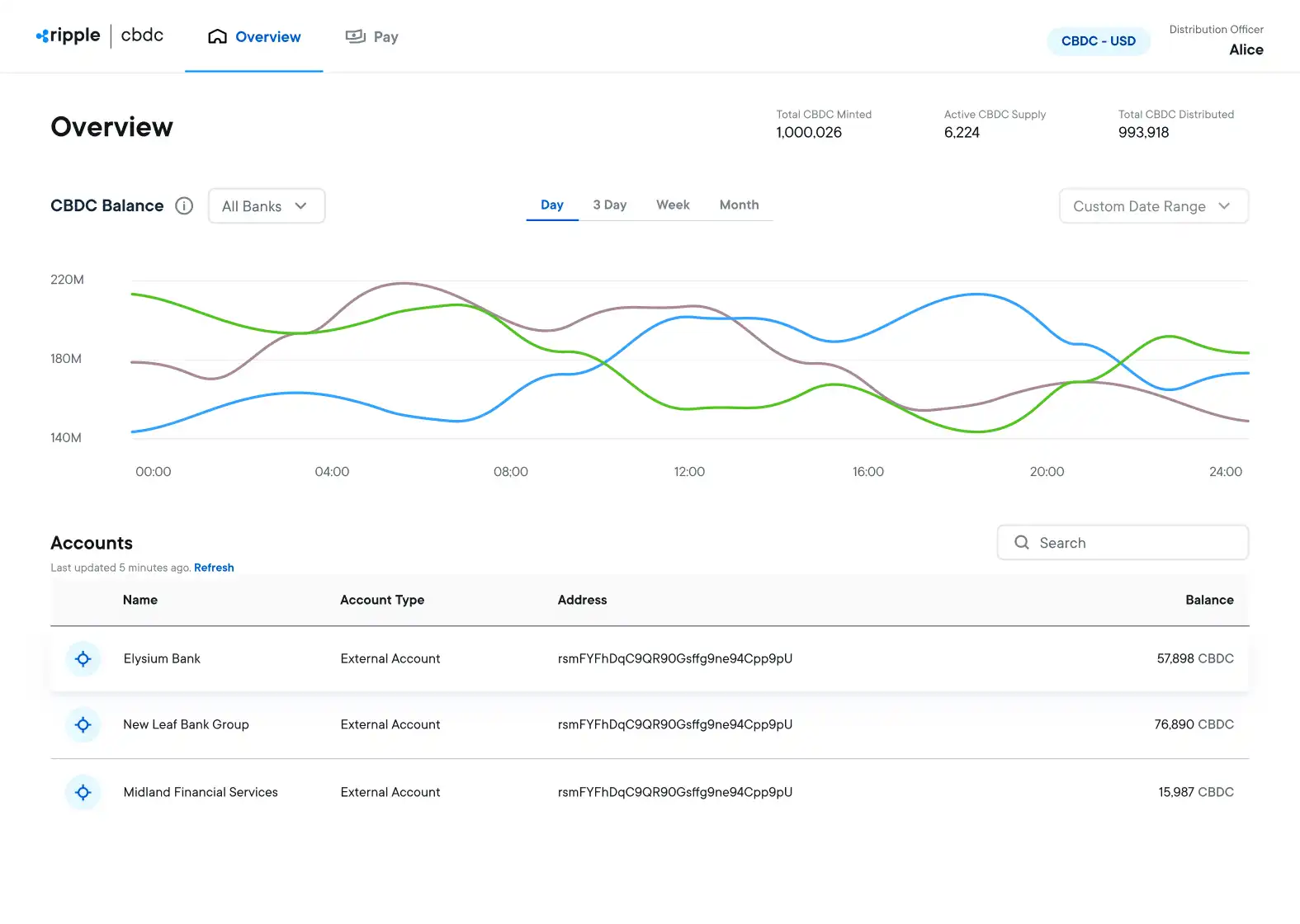

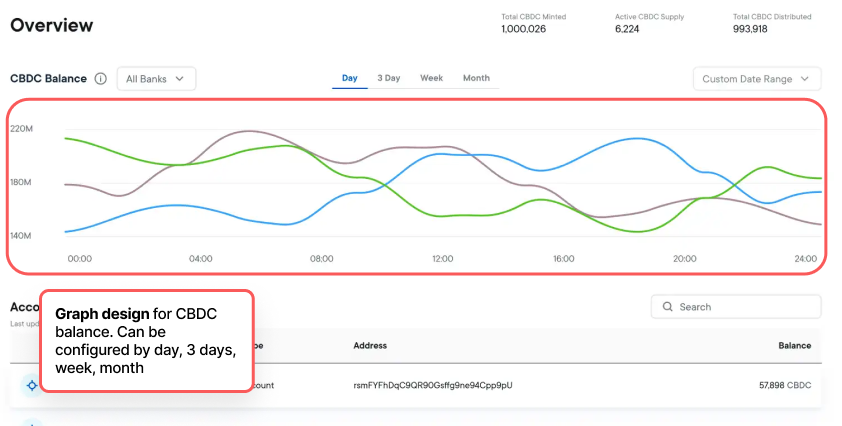

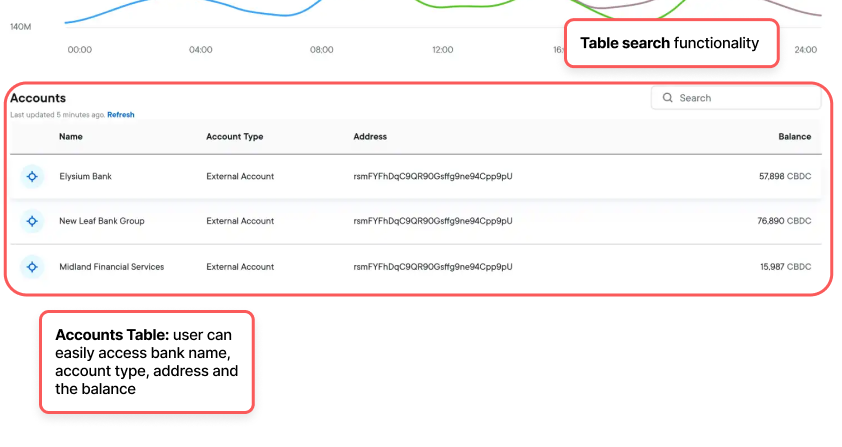

- The Ripple CBDC Platform offers a comprehensive platform for minting, managing, transacting, and destroying CBDCs and stablecoins.

Project Scope

- Product Design, UI / UX

- Wireframing

- Design System

Timing

- 2 years

Industry

- Crypto, Fintech, B2B